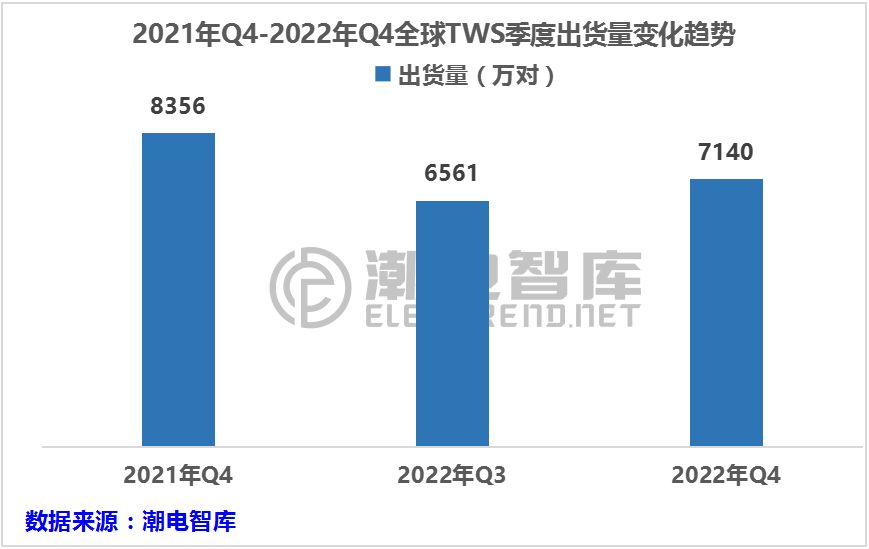

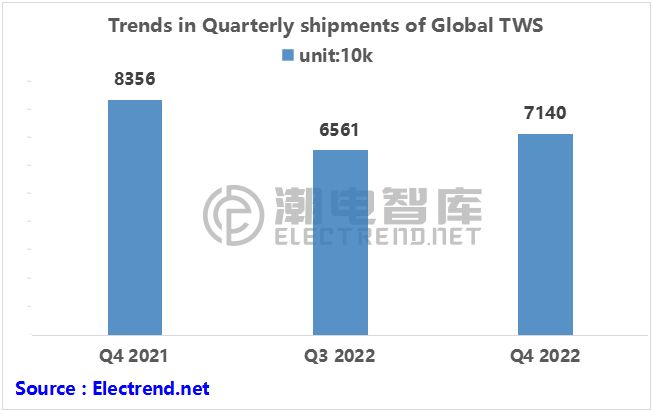

01总出货量7140万对,同比下滑14.5%

潮电智库统计,2022年Q4全球TWS的总销量为7140万对,同比下滑14.5%,环比增长8.1%。

潮电智库认为,一方面受到2022年全球智能手机出货量下滑的影响,TWS市场表现低迷。另一方面,受疫情的影响,全球消费偏向保守,同时TWS产品缺乏创新,难以拉动消费需求。

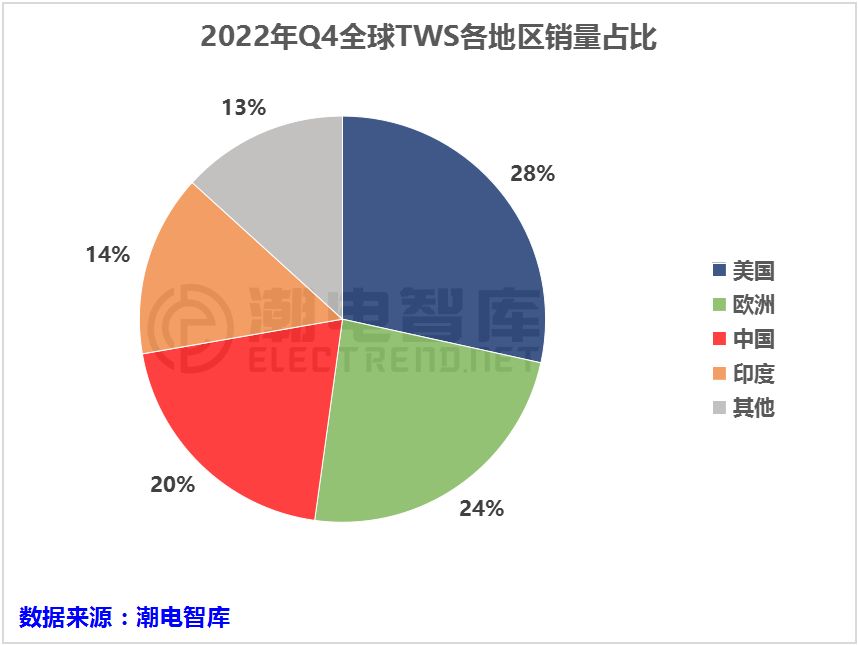

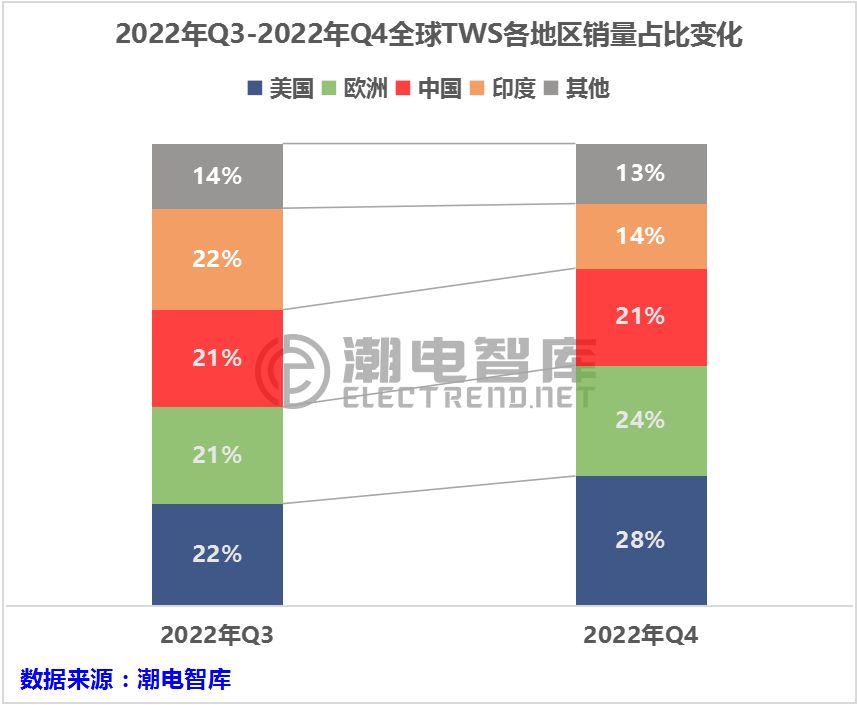

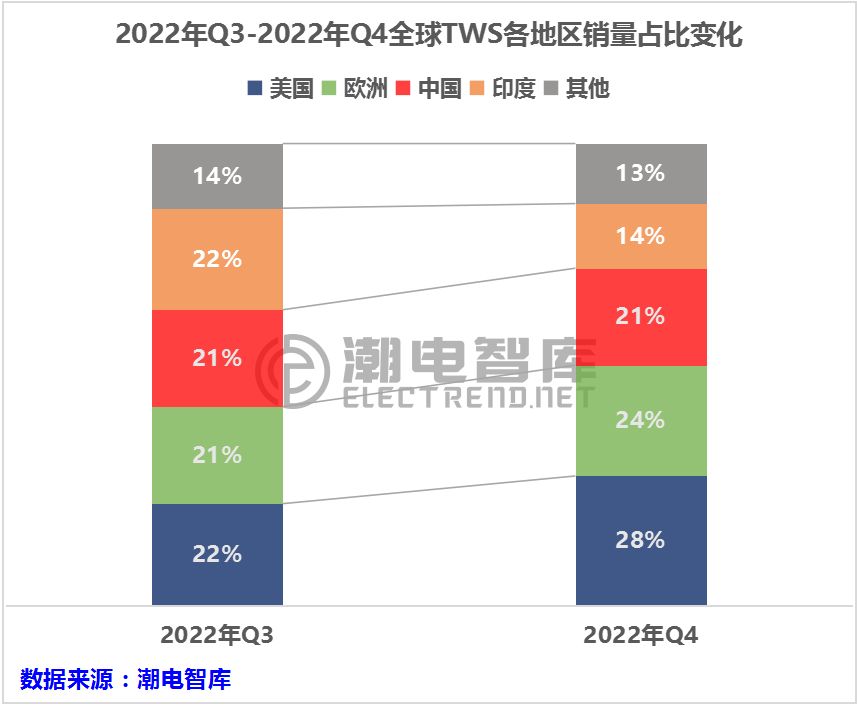

02地区占比,美国再成全球最大市场

2022年Q4,美国以28%的销量占比成为全球TWS最大市场;印度排在最后,份额不足15%(Q3是全球TWS最大消费市场)。

值得注意的是,从环比变化来看,印度TWS市场势态急转而下,下滑了28%,而美国和欧洲的TWS市场快速升温,出货量环比分别增长45%、21%。因此,美国>欧洲>中国>印度的市场格局得以形成。

同比来看,印度激增53%;其他地区均下滑,美国、欧洲和中国各自下降25%、21%、18%。

美国和欧洲TWS市场的活跃,主要离不开苹果、哈曼、捷朗波、Beats等本土品牌的出色表现,两个地区TWS销量以电商渠道为主,其线下渠道也较为多样化。

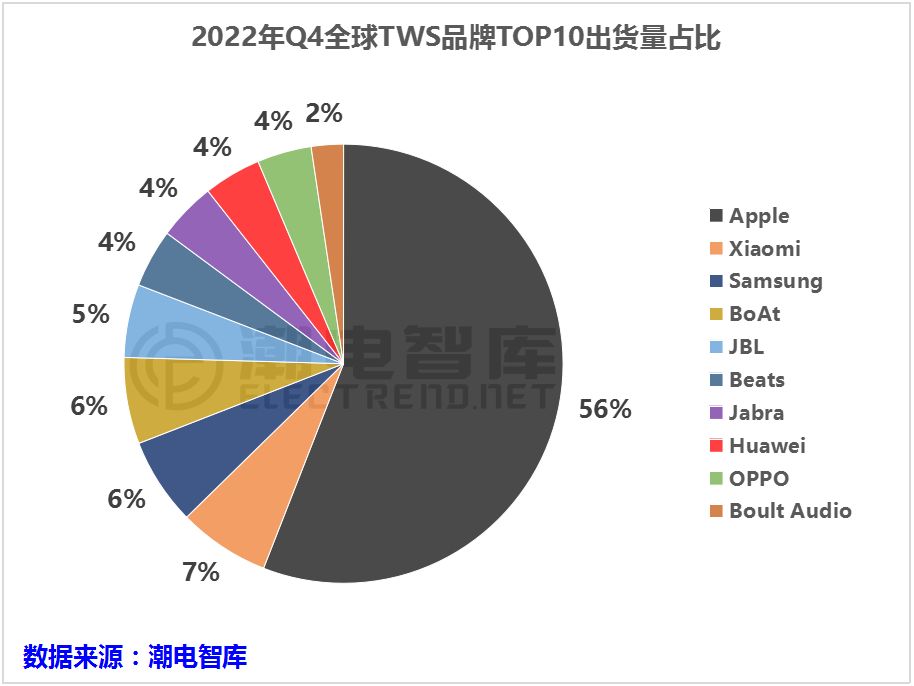

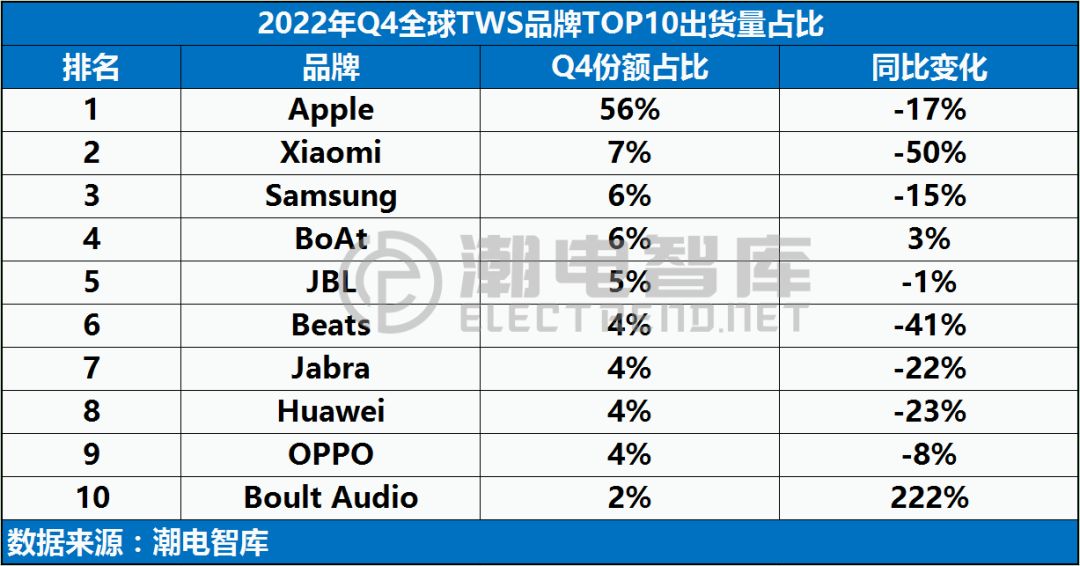

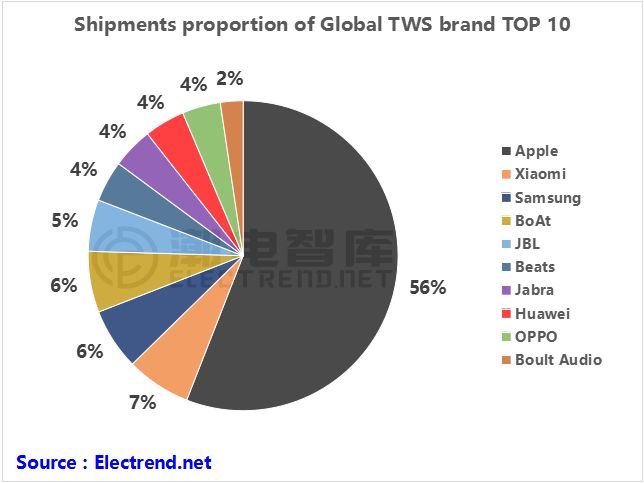

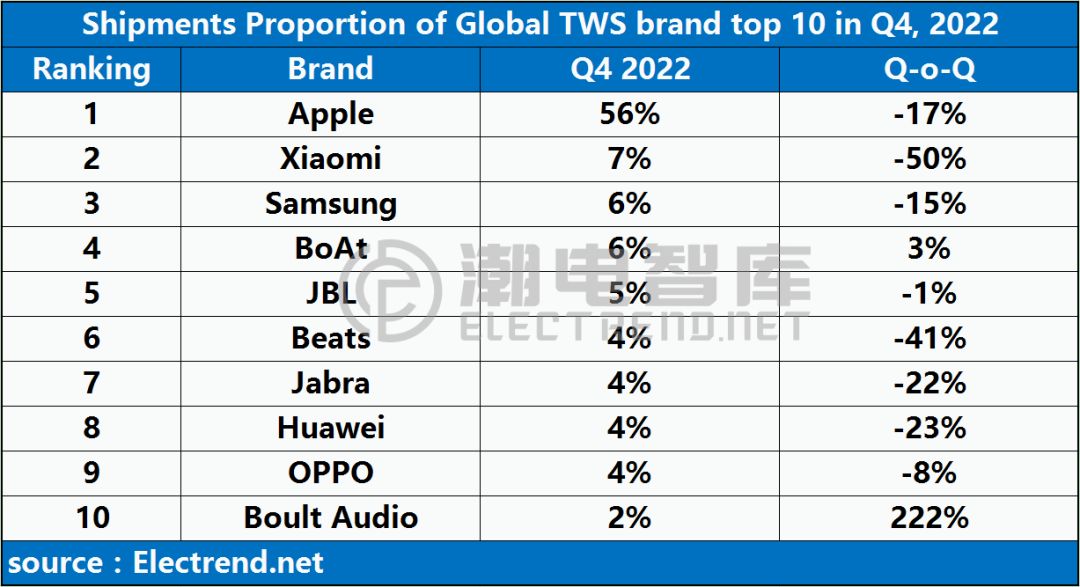

03苹果占品牌市场五成,Boult Audio暴涨

从品牌端看,TWS出货量在2022年Q4 排名前三的分别是苹果、小米和三星。苹果独占TOP10品牌TWS市场份额的56%,而其他单个品牌的市场份额不足10%。

全球TWS市场降温,印度Boult Audio和BoAt却逆势上涨,其中Boult Audio出货量增幅高达222%;国内一众TWS品牌,如小米、华为和OPPO,同比均下跌,其中小米回落50%,OPPO下降8%,美国品牌Beats也下跌41%。

小结

2022年Q4,全球TWS出货量7140万对,同比增长下滑14.5%。市场有所降温,主要在于全球消费电子行业的疲软以及消费者对TWS的低欲望。

去年Q4印度市场增长量最大的是Boult Audio,同比增幅高达222%,但印度TWS总出货量环比浮动较大,下滑28.4%。

由于需求疲软,国内主流TWS品牌Q4的出货量表现不佳。

2022 Q4 Global TWS Market Analysis Report

1、The total shipment volume was 71.4 million pairs, decrease 14.5% from the previous year

According to Electrend data research, the total sales volume of global TWS in Q4 in 2022 was 71.4 million pairs, a year-on-year decrease of 14.5%, and a month-on-month increase of 8.1%.

Electrend believes that, on the one hand, affected by the decline in global smartphone shipments in 2022, the TWS market is performing poorly. On the other hand, due to the impact of the epidemic, global consumption tends to be conservative, while TWS products lack innovation, making it difficult to stimulate consumer demand.

2、Regional share: The United States once again becomes the world’s largest TWS market

In Q4 2022, the United States became the world’s largest TWS market with a sales share of 28%; India ranks last with a share of less than 15% (Q3 is the world’s largest consumer market for TWS).

It is worth noting that from the perspective of month-on-month changes, the trend of the Indian TWS market has turned sharply downward, declining by 28%, while the TWS market in the United States and Europe has rapidly warmed up, with shipments increasing by 45% and 21% month-on-month respectively. Therefore, the market pattern of the United States, Europe, China, and India has been formed.

In terms of year-on-year growth, India experienced a surge of 53%; Other regions have declined, with the United States, Europe, and China each falling by 25%, 21%, and 18%.

The active TWS market in the United States and Europe is mainly dependent on the outstanding performance of local brands such as Apple, Harman, Jerobo, and Beats. The sales of TWS in the two regions are mainly through e-commerce channels, and their offline channels are also relatively diversified.

3、Top 10 brands: Apple accounts for half of the market, and Boult Audio has soared

From the brand perspective, the top three TWS shipments in Q4 2022 were Apple, Xiaomi, and Samsung. Apple alone accounts for 56% of the top 10 brand TWS market share, while other individual brands have less than 10% of the market share.

While the global TWS market has cooled, Boult Audio and BoAt in India have bucked the trend and increased, with the shipment volume of Boult Audio increasing by up to 222%; A number of domestic TWS brands, such as Xiaomi, Huawei, and OPPO, all fell year on year, with Xiaomi down 50%, OPPO down 8%, and American brand Beats also down 41%.

Summary

In Q4 2022, the global TWS shipment volume was 71.4 million pairs, a year-on-year increase of 14.5%. The market has cooled, mainly due to the weakness of the global consumer electronics industry and consumers’ low desire for TWS.

The largest growth in the Indian market in Q4 last year was Boult Audio, with a year-on-year increase of 222%. However, the total shipment volume of TWS in India fluctuated significantly on a month-on-month basis, declining by 28.4%.

Due to sluggish demand, the domestic mainstream TWS brand in Q4 has a bad performance.