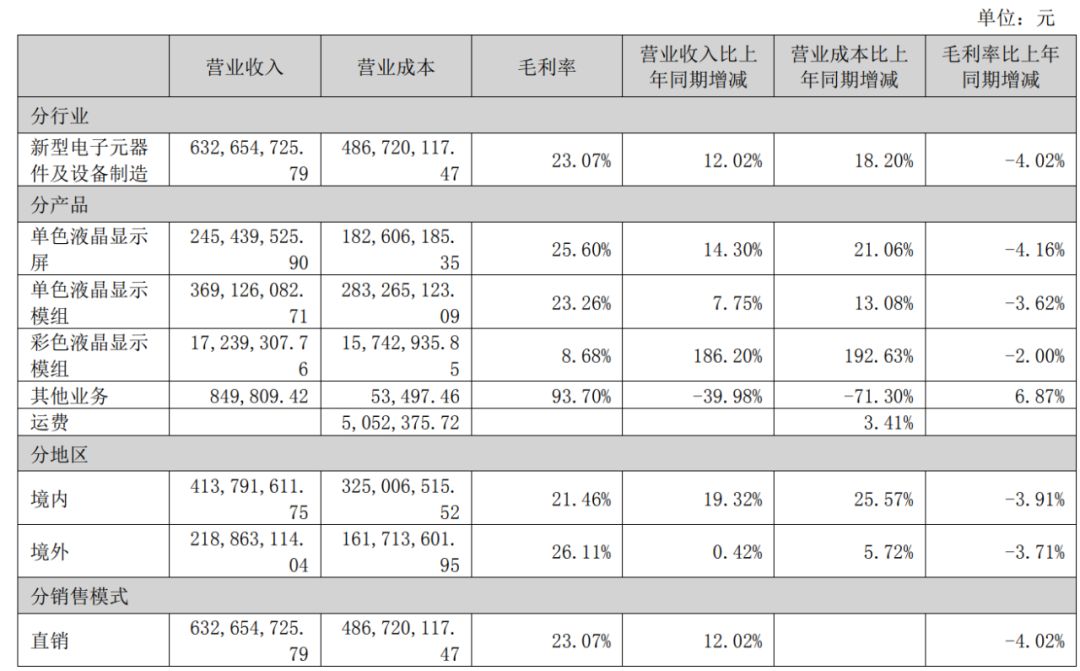

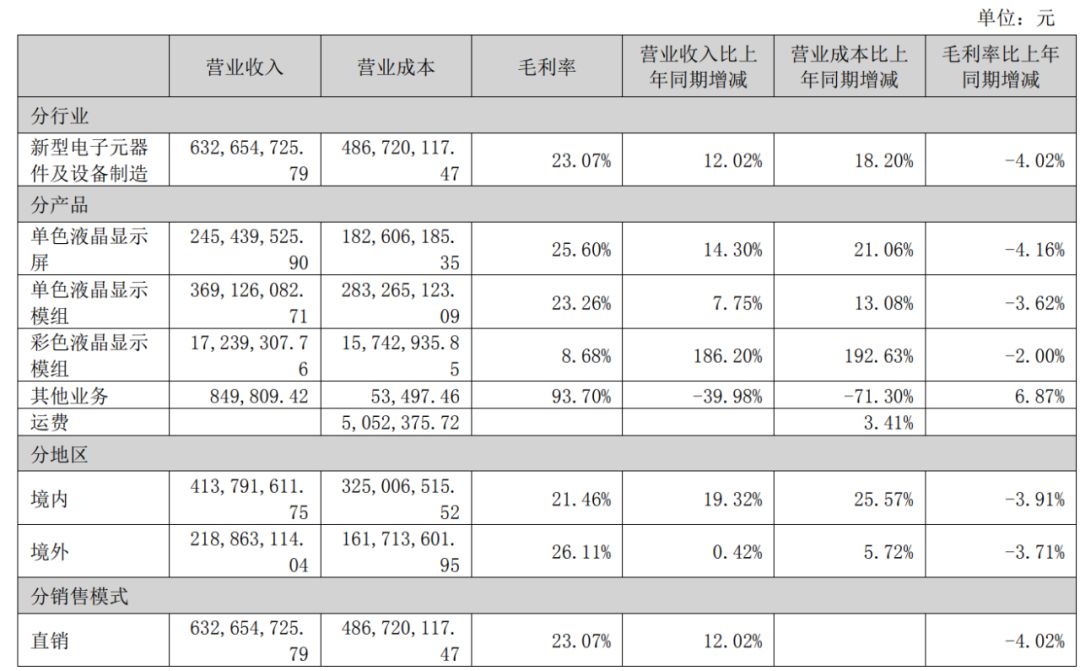

近日骏成科技发布的年报内容显示,公司2022年营业收入6.32亿元;归属于上市公司股东的净利润0.91亿元,同比增长15.53%;基本每股收益1.2776元。公司拟以总股本72,586,668为基数,向全体股东每10股派6元。

其中2022年第四季度,公司单季度主营收入1.58亿元,同比上升2.13%;单季度归母净利润2020.6万元,同比上升17.89%。

骏成科技主营业务专注于液晶专业显示领域,主要从事定制化液晶专显产品的研发、设计、生产和销售,主要产品为TN型(含 HTN 型)、STN型、VA型液晶显示屏和模组以及TFT型液晶显示模组。产品应用于工业控制、汽车电子、智能家电、医疗健康等专显领域,主要销往 中国及日本、欧美、东南亚等多个国家和地区,广泛应用于卡西欧、松下、博世、日立、罗氏、拜耳、三菱等知名企业的产品中。公司凭借在产品研制以及市场声誉等方面的优势,在细分领域具备较强的竞争力。

骏成科技认为,应用场景、品类、客户需求多元化,液晶专显屏生产向小批量定制化发展。物联网是移动互联网的新兴应用,伴随5G、Wifi6等通信技术的逐渐应用,物联网芯片等硬件价格的持续走低,低耗电量液晶显示屏的成熟,交互导向的万物互联的时代正在快速发展。

电子产品快速的迭代、新应用场景的出现、新品类的诞生以及客户需求的多元化导致液晶专显屏等智能产品零部件的生产向小批量定制化的方向发展。该模式对液晶专显屏生产制造企业的销售生产制造等方面提出新的要求。液晶专显屏生产制造企业需要拥有快速洞察下游发展的客户需求导向能力、更加敏捷的开发能力和产品设计力、更加柔性的生产能力和高度协同的上游供应链。行业已经摆脱了比拼屏幕生产大小的阶段,运营效率成为盈利的决定性因素。

传统的液晶专显屏一般应用于小型消费品和工业控制品上,未来,伴随产品向消费端和车联网的发展,屏幕尺寸将会出现两极化及异型化发展。例如,车载仪表显示屏的大小由原来的指针显示表盘结合3-5英寸液晶显示屏变成目前10-13英寸全液晶显示屏,车载流媒体后视镜变为9英寸液晶显示屏,不同厂家的车载仪表显示屏和流媒体后视屏形状也不尽相同。屏幕尺寸的提升和差异化形状导致屏幕的线路设计、阻值平衡、均匀性控制、异物控制的难度都进一步增大,对制造过程和工艺要求明显提升。

在车载显示领域,骏成科技是汽车电子领域中车载液晶显示屏产品的二级供应商。目前,公司产品通过威奇尔、伟世通(天宝汽车)、天有为、新通达等一级供应商渠道交付应用于上汽集团(600104)、吉利汽车、长安汽车、北京汽车、奇瑞汽车、东风汽车(600006)等国内主要汽车主机厂商。

骏成科技表示公司凭借多年的技术积累和丰富的液晶显示屏产品定制化制造经验,在汽车电子的车载液晶显示屏领域走出了一条创意之路。在市场上主流车载液晶显示屏是TFT彩屏的情况下,公司根据自主研发的高精度彩膜贴附技术、息屏一体黑以及TFT光学贴合技术,开创出了应用于汽车仪表控制的车载大尺寸VA型液晶显示屏,不仅在包括对比度、色饱和度、 抗静电能力和防抖动等产品的各项参数上能做到比原有的TFT彩屏更好的指标效果,而且更具备美观性和科技感,更为重要的是大幅降低了车载显示屏的生产成本。公司创意研发的车载显示屏产品具备强大的成本优势和性能优势,当前已 具备产业化生产的能力。

目前汽车电子领域,随着行车安全、导航系统、车载娱乐系统的增加,车内显示屏逐渐向对大尺寸、一体化等方向升级;此外,新能源、自动驾驶汽车的快速兴起将带动车载显示需求提升。

骏成科技于2022年1月28日在深交所创业板上市,募集资金5.50亿元,分别用于车载液晶显示模组生产项目、TN、HTN产品生产项目、研发中心建设项目、补充流动资金。

Focusing on the vehicle display and IOT, Juncheng Technology profit continues to grow

According to the annual report released by Juncheng Technology recently, the company’s operating revenue in 2022 was 632 million yuan; The net profit attributable to shareholders of listed companies was 91 million yuan, a year-on-year increase of 15.53%; Basic earnings per share are 1.2776 yuan. The company plans to distribute 6 yuan per 10 shares to all shareholders based on the total capital stock of 72586668.

In the fourth quarter of 2022, the company’s single quarter main revenue was 158 million yuan, up 2.13% year-on-year; The net profit attributable to the parent company in a single quarter was 20.206 million yuan, up 17.89% year-on-year.

Juncheng Technology’s main business is focused on the field of professional liquid crystal displays, mainly engaged in the research and development, design, production, and sales of customized liquid crystal display products. Its main products include TN type (including HTN type), STN type, VA type liquid crystal displays and modules, as well as TFT type liquid crystal display modules. The products are used in specialized display fields such as industrial control, automotive electronics, smart home appliances, medical and health care, and are mainly sold to China, Japan, Europe, the United States, Southeast Asia, and other countries and regions. They are widely used in the products of well-known enterprises such as Casio, Panasonic, Bosch, Hitachi, Roche, Bayer, and Mitsubishi. With its advantages in product development and market reputation, the company has strong competitiveness in the field of segmentation.

Juncheng Technology believes that the application scenarios, categories, and customer needs are diversified, and the production of dedicated LCD screens is developing towards small batch customization. The Internet of Things is an emerging application of the mobile internet. With the gradual application of communication technologies such as 5G and WiFi 6, the prices of hardware such as Internet of Things chips continue to decline, the maturity of low power LCD displays, and the era of interactive Internet of Things is rapidly developing.

The rapid iteration of electronic products, the emergence of new application scenarios, the birth of new categories, and the diversification of customer demand have led to the development of small batch customization in the production of intelligent product components such as LCD screens. This mode puts forward new requirements for sales, production, and manufacturing of LCD specialized display screen manufacturers. LCD screen manufacturing enterprises need to have customer demand oriented capabilities that quickly insight into downstream development, more agile development capabilities and product design capabilities, more flexible production capabilities, and a highly collaborative upstream supply chain. The industry has emerged from the stage of competing screen production sizes, and operational efficiency has become a decisive factor in profitability.

Traditional LCD display screens are generally used in small consumer goods and industrial control products. In the future, with the development of products towards the consumer end and the Internet of Vehicles, the screen size will undergo polarization and heterogeneous development. For example, the size of the vehicle instrument display screen has changed from the original pointer display dial combined with a 3-5 inch LCD screen to the current 10-13 inch full LCD screen, and the vehicle streaming rearview mirror has changed to a 9-inch LCD screen. The shapes of vehicle instrument displays and streaming rearview screens from different manufacturers also vary. The increase in screen size and differentiated shapes have further increased the difficulty of screen circuit design, resistance balance, uniformity control, and foreign matter control, significantly increasing the requirements for manufacturing processes and processes.

In the field of vehicle display, Juncheng Technology is a secondary supplier of vehicle LCD products in the field of automotive electronics. Currently, the company’s products are delivered and applied to major domestic automotive host manufacturers such as SAIC Motor Corporation (600104), Geely Automobile, Chang’an Automobile, BAIC Motor, Chery Automobile, Dongfeng Automobile (600006), etc. through first-class supplier channels such as Weiqier, Visteon (Tianbao Automobile), Tianyouwei, and Xintongda.

Juncheng Technology said that with years of technical accumulation and rich experience in customized manufacturing of LCD products, the company has found a creative path in the field of automotive electronics and on-board LCD screens. In the case of TFT color screens, which are the mainstream vehicle LCD screens in the market, the company has created a large vehicle size VA type LCD screen for automotive instrument control based on self-developed high-precision color film attachment technology, integrated black color display and TFT optical attachment technology, not only in terms of contrast, color saturation The various parameters of products such as antistatic capability and anti shake can achieve better indicator effects than the original TFT color screen, and have a more aesthetic and technological sense. More importantly, the production cost of vehicle mounted display screens has been significantly reduced. The innovative vehicle display products developed by the company have strong cost advantages and performance advantages, and currently have the capacity for industrial production.

At present, in the field of automotive electronics, with the increase of driving safety, navigation systems, and in-vehicle entertainment systems, the in-vehicle display screen is gradually upgrading towards large size, integration, and other directions; In addition, the rapid rise of new energy and autonomous vehicle will drive the demand for on-board displays.

Juncheng Technology was listed on the Growth Enterprise Market of Shenzhen Stock Exchange on January 28, 2022, raising 550 million yuan for the production of vehicle mounted LCD modules, TN, HTN product production projects, R&D center construction projects, and supplementary working capital.