蓝黛科技(SZ:002765)发布年度业绩报告显示,2022年由于上游市场供需形势对中下游产业产生持续性影响,芯片短缺、原材料价格上涨、商用车排放标准调整等因素对企业生产经营构成一定影响,蓝黛科技实现营收28.73亿元,同比下降8.47%;扣非净利润1.37亿元,同比增长10%。

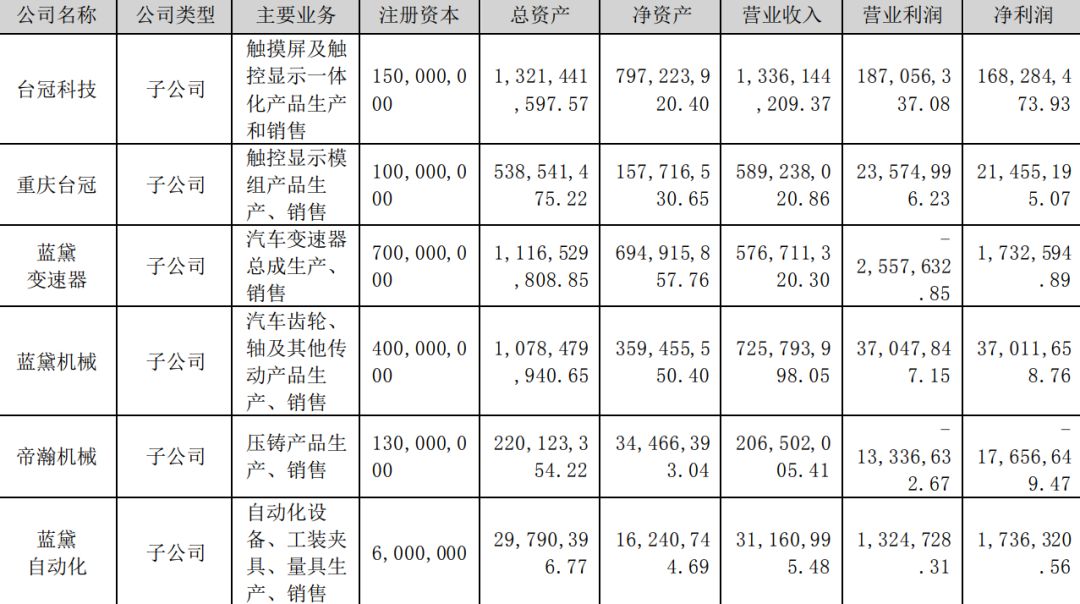

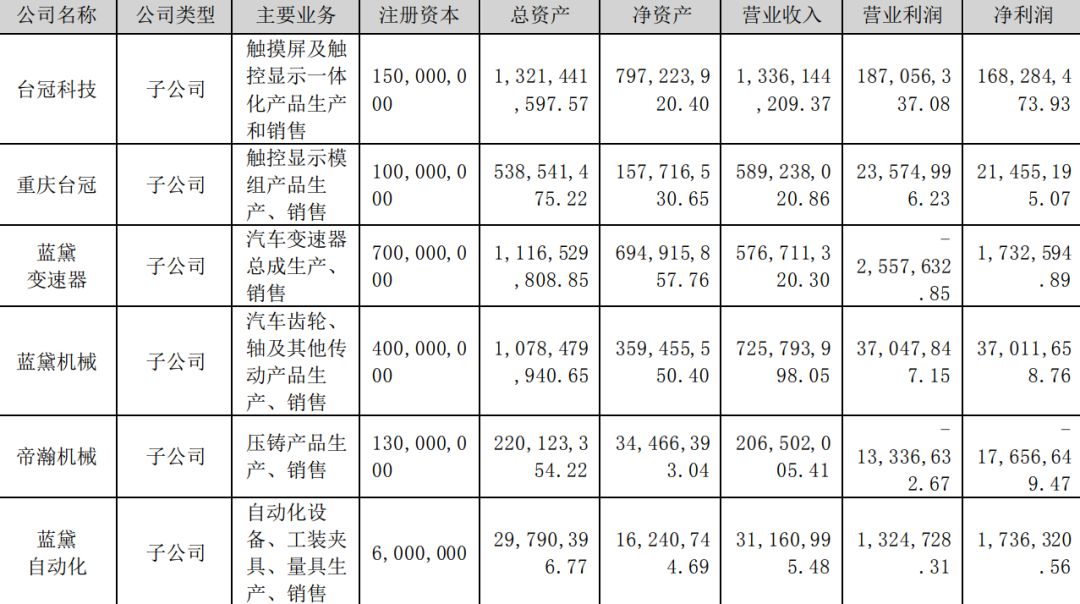

触控显示业务方面,公司重点拓展车载触控显示业务的市场策略,充分发挥在中大尺寸触控屏领域的核心优势,实现业务的持续发展。其中台冠科技净利润1.68亿,重庆台冠净利润0.21亿,触控显示业务共计1.89亿净利润。

同时蓝黛科技公告称,根据公司经营发展需要,董事会同意公司收购潘尚锋先生持有的公司控股子公司重庆台冠科技有限公司31%股权,重庆台冠股东全部权益的评估值为人民币2.31亿元,同意公司本次收购重庆台冠股权的转让价款为人民币7130万元,公司拟以自有资金支付上述股权转让价款。本次股权收购完成后,公司将持有重庆台冠82%的股权,重庆台冠仍为公司控股子公司。

蓝黛科技的触控业务来自于收购的台冠科技,2018年5月23日,蓝黛传动出资7695万元通过增资+受让股权方式参股台冠科技10%的股权;2019年5月20日,公司又通过非公开发行股份+现金方式收购了台冠科技89.6765%的股权:2021年9月9日蓝黛科技收购徐阿玉持有的台冠科技0.3235%股权,完成对台冠科技的100%控股。

依托台冠科技以及后来新建的重庆台冠,蓝黛传动目前已掌握中大尺寸触摸屏的加工技术、行业领先的GF工艺,形成了以盖板玻璃、触控屏、显示模组及触控显示一体化模组的全产品生产模式,能够为客户提供一站式服务。产品主要应用于平板电脑、笔记本电脑、车载显示、工控终端等领域。

近年来,在智能手机和平板电脑的引领下,全球智能化产品技术水平不断提高,智能化需求已由消费类领域逐 渐向工控、车载等领域不断延伸,对触摸屏和中大尺寸显示屏的需求不断增加。

2022年蓝黛科技进一步加大盖板玻璃产品开发和市场推广力度,将业务向车载、工控领域延展,积极把握新能源汽车发展机遇,结合自身技术优势,通过“车载、工控触控屏盖板玻璃扩产项目”积极布局扩产车载盖板玻璃、工控盖板玻璃以及3D盖板玻璃等产品,促进公司产品竞争力的提升,为盖板玻璃业务持续快速发展奠定良好基础。

报告期,公司紧抓新能源汽车及汽车智能座舱的发展趋势,围绕车载触控屏发展战略,充分利用客户联动优势,加快新品研发拓展。公司与华阳电子、重庆矢崎、创维等国内知名Tier1企业深度合作,开发高附加值的双联屏、三联屏、曲面屏等车载触控产品,产品应用在长城汽车、吉利汽车、五菱汽车等终端产品上。

蓝黛科技自身原有业务为汽车上游零配件制造商,主力打造汽车发动机平衡轴总成及零部件、新能源减速器及新能源传动系统零部件、自动变速器总成的核心产品群。新能源传动系统零部件是公司未来核心产品之一,目前公司已与国际知名企业、日电产、法雷奥西门子、格雷博、金康动力等新能源车企及tier1展开合作,最终用户包括北美知名车企、吉利、上汽、比亚迪、金康等整车厂。后续公司将加大汽车新能源领域产能扩建,进一步开拓市场,提升核心竞争力。

自切入新能源汽车赛道以来,产品结构和客户结构持续优化。新能源车传动和车载显示产品的收入占比持续提升,北美知名车企、国内一线车企等大客户不断突破。去年蓝黛科技非公开发行事项已获批准,募资规模为5.9亿元,将用于新能源车传动生产制造和车载/工控触显产品扩产。在新能源车相关领域布局深化、产能扩张等推动下,未来公司的市场份额有望持续提升。

蓝黛科技表示,全球主要的触摸屏生产厂商集中于日韩、中国台湾地区和中国大陆,构成了三个不同的产业集群。日韩企业技术领 先,掌握高端技术产品;台湾企业拥有规模优势和代工业的客户积累,主攻中高端市场;中国大陆企业处于快速发展期, 技术和规模成长迅速,并逐步向中高端市场渗透。

蓝黛科技子公司台冠科技一直将全球领先厂商作为重点目标客户,经过近几年 的发展,已拥有亚马逊、京东方、仁宝工业、GIS、群创电子、广达电脑、华勤通讯等行业知名客户,产品最终应用于亚 马逊、联想、宏基等终端品牌电子产品。

行业报告显示,中国大陆显示产业在过去十多 年内,规模持续增长,12年-21年,年均复合增长率高达25.8%,2022年中国大陆企业显示面板年产能达到2亿平方米,占全球的60%左右。我们认为中国大陆企业已成为面板行业核心玩家。

Touch screen profit of 189 million, Landai Technology Technology acquired another 31% stake in Chongqing Taiguan shareholders

Landai Technology (SZ:002765) released its annual results report, showing that in 2022, due to the upstream market supply and demand situation on the midstream and downstream industries with a sustained impact, chip shortage, rising raw material prices, commercial vehicle emission standards adjustment and other factors on the production and operation of enterprises constitute a certain impact, Landa Technology achieved revenue of 2.873 billion yuan, down 8.47% year-on-year; deducted non-net profit of 137 The company’s revenue was RMB 2.873 billion, down 8.47% year-on-year; net profit after deduction was RMB 137 million, up 10%.

Touch display business, the company focused on expanding the market strategy of automotive touch display business, giving full play to its core strengths in the field of medium and large size touch screens to achieve sustainable business development. Among them, Taiguan Technology net profit of 168 million, Chongqing Taikuan net profit of 0.21 billion, touch display business a total of 189 million net profit.

At the same time, Landai Technology announced that, according to the company’s business development needs, the board of directors agreed to the company’s acquisition of Mr. Pan Shangfeng’s controlling subsidiary of Chongqing Taiguan Technology Co. The Company intends to pay the said equity transfer price with its own funds. After the completion of this equity acquisition, the Company will hold 82% equity interest in Chongqing Taiguan, and Chongqing Taiguan will remain as a controlling subsidiary of the Company.

Landai Technology’s touch business comes from the acquired Taiguan Technology. On May 23, 2018, Landai Technology Drive contributed 76.95 million yuan to participate in 10% of Taiguan Technology through capital increase + equity transfer; on May 20, 2019, the company also acquired 89.6765% of Taiguan Technology through non-public share issuance + cash: on September 9, 2021, Landai Technology acquired 0.3235% equity interest in Tai Guan Technology held by Xu Ayu, completing its 100% holding in Tai Guan Technology.

Relying on Taiguan Technology and later the newly built Chongqing Taiguan, Landai Technology has mastered the processing technology of medium and large size touch screen, industry leading GF process, formed a full product production mode with cover glass, touch screen, display module and touch display integrated module, and can provide one-stop service for customers. Our products are mainly used in tablet PC, notebook PC, car display, industrial control terminal and other fields.

In recent years, led by smart phones and tablet PCs, the global technology level of intelligent products has been improving, and the demand for intelligence has been gradually extended from consumer fields to industrial control and automotive fields, and the demand for touch screens and medium and large size displays has been increasing.

In 2022, Landai Technology will further increase the development and marketing of cover glass products, extend its business to the field of automotive and industrial control, actively grasp the opportunity of new energy vehicle development, combine its own technical advantages, and actively layout and expand the production of automotive cover glass, industrial control cover glass and 3D cover glass through the “automotive and industrial control touch panel cover glass expansion project”. and 3D cover glass to promote the competitiveness of the company’s products and lay a good foundation for the sustainable and rapid development of cover glass business. During the reporting period, the company grasped the development trend of new energy vehicles and automotive intelligent cockpits, focused on the development strategy of automotive touch screen, made full use of the advantage of customer linkage, and accelerated the development and expansion of new products. The company cooperated deeply with well-known domestic Tier1 enterprises such as ADAYO, chongqing YAZAKI METER CO., LTD and Skyworth to develop high value-added double-linked screen, triple-linked screen, curved screen and other in-vehicle touch products, which were applied to the terminal products of Great Wall Motor, Geely Automobile and Wuling Automobile.

Landai Technology’s original business is a manufacturer of upstream automotive parts and components, focusing on building a core product group of automotive engine balance shaft assembly and parts, new energy reducer and new energy transmission system parts, and automatic transmission assembly. New energy transmission system parts is one of the company’s future core products, the company has been cooperating with internationally renowned enterprises, Nidec, Valeo Siemens, Graber, Jin Kang Power and other new energy vehicle enterprises and tier1, end users include North America’s leading car companies, Geely, SAIC, BYD, Jin Kang and other vehicle manufacturers. In the future, the company will increase the capacity expansion in the field of automotive new energy to further develop the market and enhance its core competitiveness.

Since entering the new energy vehicle track, the product structure and customer structure have been continuously optimized. The revenue share of new energy vehicle transmission and in-vehicle display products continues to increase, and large customers such as famous North American car companies and domestic first-tier car companies continue to break through. Last year, Landai Technology’s non-public offering was approved, with a fundraising scale of 590 million yuan, which will be used for new energy vehicle transmission manufacturing and vehicle/industrial control touch screen product expansion. In the new energy vehicle-related areas to deepen the layout, production capacity expansion and other promotion, the company’s market share is expected to continue to improve.

Landai Technology said that the world’s major touch screen manufacturers are concentrated in Japan and South Korea, Taiwan and China, constituting three different industrial clusters. Japanese and Korean companies are the technological leaders, mastering high-end technology products; Taiwan companies have the scale advantage and the accumulation of customers in the OEM industry, mainly in the middle and high-end market; Chinese mainland companies are in a period of rapid development, rapid growth in technology and scale, and gradually penetrate into the middle and high-end market.

Through the development in recent years, it has already had some famous customers in the industry, such as Amazon, BOE, Compal, GIS, Grouptronics, Quanta Computer, Huaqin Communication, etc. The products are finally applied to Amazon, Lenovo, Acer and other terminal brand electronic products.

Industry reports show that China’s display industry in the past decade, the scale of sustained growth, 12 years-21 years, the average annual compound growth rate of up to 25.8%, in 2022 the annual production capacity of mainland Chinese companies display panels to 200 million square meters, accounting for about 60% of the world. We believe that mainland Chinese companies have become the core players in the panel industry.