几成标配的车载摄像头,随新汽车工业时代到来而进入狂飙模式。

3月上旬,据工信部第369批《道路机动车辆生产企业及产品公告》变更扩展公示,特斯拉中国产Model Y车型进行了信息变更备案,新版车型改为“无雷达”的纯视觉方案。

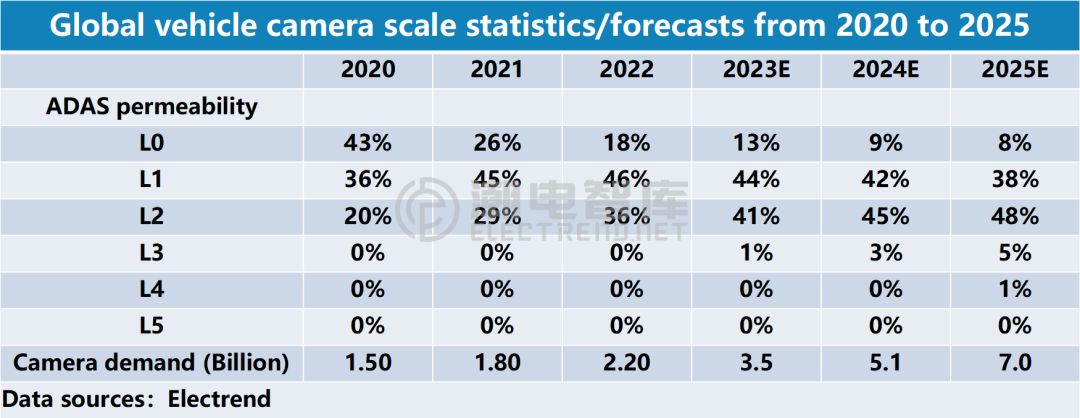

潮电智库估算,2023年全球车载摄像头出货量在2.8亿至3亿颗之间,如果消费经济快速复苏,汽车智能创新贴合市场需求,甚至有望突破3亿大关。

作为智能汽车产业发展高地,2023中国单车摄像头搭载量将达到4颗,高于全球平均水平3.2颗。其中造车新势力更为激进,平均单车摄像头搭载量有望达到7颗。

“2023将是汽车行业的大变革之年,全球迎来L2向L3/L4跨越窗口。”多位智能驾驶领域专家一致认为,车载摄像头作为感知层核心传感器,随汽车ADAS功能持续升级,迎来量价齐升机遇。

行业大步向前,三大发展趋势已然呈现。

一. 智能

根据车载产业专家预测,2023年ADAS配置率会大大提高,基本成为车厂标配,尤其是前向AEB的普及率进入快速上升通道。

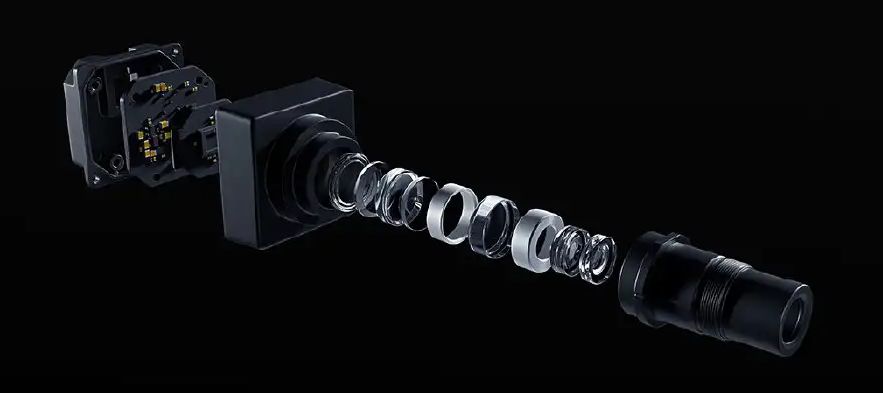

激光雷达、毫米波雷达和摄像头是自动驾驶中常见的三种传感器。相比之下,车载摄像头成本低,并且硬件技术相对较成熟,因此率先成为汽车智能化应用的核心传感器。

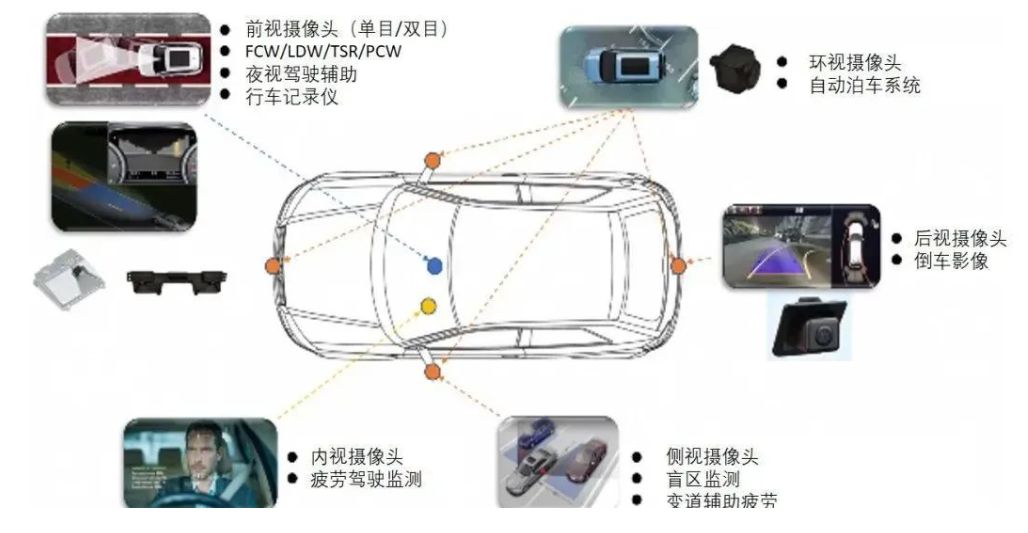

当前车载摄像头被视为“智能驾驶之眼”,是汽车主动控制功能的信号入口,并与算法相结合,从而实现车道偏离预警(LDW)、汽车碰撞预警(FCW)等ADAS功能。

按应用领域划分,车载摄像头可分为行车辅助(行车记录仪、高级辅助驾驶系统ADAS与主动安全系统)、驻车辅助(全车环视)与车内人员监控,贯穿行驶到泊车全过程,对摄像头工作时间和温度等方面有较高的要求。

车载摄像头的应用逻辑属于“重感知,轻技术”,与智能手机或者安防行业属性完全不同。一般来说,智能手机摄像头更多在于分享,比如高清和美颜;安防摄像头则重记录,场景相对固定和静态;车载摄像头更倾向智能化,在于实时感知各种路况,并与算法及处理芯片融合形成智能驾驶系统。

二. 高清

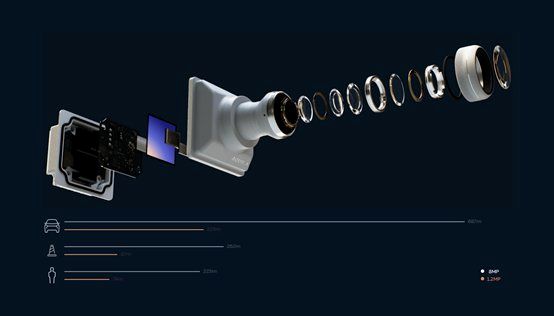

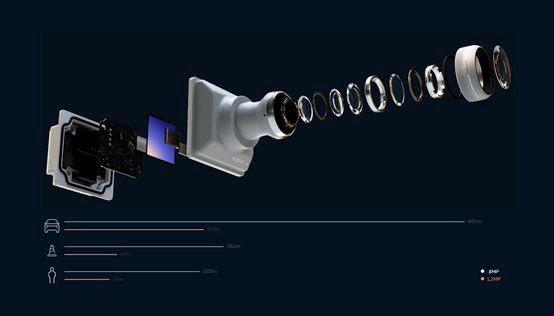

根据现有信息,蔚小理、极氪、哪吒等造车新势力已经率先搭载目前最高规格的800万像素ADAS摄像头,传统车企也相继跟进,如预计今年Q2上市的长城沙龙机甲龙,搭载了7颗800万超高清摄像头。

此外,环视摄像头将从1M往3M进阶,并成为主流。

在供应层面,联创电子已经联合黑芝麻智能、百度Apollo等公司全球首创超1500万高像素车载摄像头产品。

高级别自驾对周围环境感知要求的提升,摄像头将向“高清化”演变,以实现其图像采集功能的提升,及探测距离、视场角的扩充。

必须指出的是,高清化会带来数据量的井喷,将对主机厂的算力、算法带来高要求和严挑战。数据处理量成倍的增长带来算力需求的提升,进而使得主机厂需对底层芯片升级,以预留更多计算资源;在算法层面,不同像素镜头因“探测距离、视角”不同导致数据包含信息不一致,进而使得原有神经网络的训练算法模型并不能完全复用,需修改协同以提高综合性能。

因此,主机厂并不会盲目追求超高清像素,而是选择关键摄像头进行升级。

三. 洗牌

车载摄像头作为近几年最火爆吸金的领域,现在谈洗牌是否为时尚早?其实不然,市场格局已在快速变化中。

一是国产替代。

目前市场份额较大占有者主要为海外一线汽车Tier1,但德赛西威、海康威视、舜宇、联创电子、欧菲光等中国力量正在全面崛起。潮电智库认为,2023年国产车载摄像头三大梯队成型,2025年会是车载摄像头供应对国外反超的时间节点。

由于汽车供应链级别概念已经非常模糊,上游供应商可以向下游整车厂提供完整的产品,因此目前国内外车载摄像头企业存在微妙的竞合关系。

二是护城河已现。

目前涌入车载摄像头赛道的新玩家,以手机起家的光学厂商居多,如丘钛和三赢兴等。相反,很多Tier1认为软件利润率要相比硬件更高,因此不再大规模投入到摄像头硬件业务。

车规产品具备认证及交付周期长的特点,而且绝对不是手机或安防产品模式简单的平移。不少欲掘金车载摄像头的厂商由于缺乏技术支持与客户资源,早早倒在市场准入门槛之外。

The global car camera up to 300 million in 2023, upcoming with 3 market trends

Several standard car camera, with the arrival of the new automotive industry era and into the wild mode.

In early March, according to the Ministry of Industry and Information Technology 369th batch of “road motor vehicle production enterprises and product announcement” changes to expand the public, Tesla China Model Y models for information change for the record, the new version of the model to “no radar” pure visual scheme.

According to Chaodian that in 2023 the global car camera shipments between 280 million to 300 million, if the rapid recovery of the consumer economy, automotive intelligent innovation to meet market demand, and even expected to exceed 300 million mark.

As the highland of smart car industry development, 2023 China’s single car camera carrying volume will reach 4, higher than the global average of 3.2. Among them, the new forces of car manufacturing is more aggressive, the average single car camera mount is expected to reach 7.

“2023 will be a year of great change in the automotive industry, with the world ushering in the L2 to L3/L4 leap window.” A number of experts in the field of intelligent driving agree that the car camera, as the core sensor of the perception layer, ushers in the volume and price opportunities with the continuous upgrade of the car ADAS function.

Industry strides forward, three major development trends have been presented.

ⅠIntelligence

According to the prediction of in-vehicle industry experts, the ADAS configuration rate will be greatly increased in 2023 and basically become the standard equipment of vehicle manufacturers, especially the popularity of forward AEB enters a fast rising channel.

LIDAR, millimeter wave radar and camera are the three common sensors in autonomous driving. In contrast, in-car camera is low cost and relatively mature hardware technology, so it becomes the first to become the core sensor of intelligent automotive applications.

Currently, in-vehicle camera is regarded as the “eye of intelligent driving”, which is the signal entrance of the car’s active control function and combined with algorithms to realize ADAS functions such as lane departure warning (LDW) and car collision warning (FCW).

According to the application area, the car camera can be divided into driving assistance (driving recorder, advanced assisted driving system ADAS and active safety system), parking assistance (full vehicle surround view) and in-car personnel monitoring, running through the whole process of driving to parking, which has high requirements on camera working time and temperature.

The application logic of the car camera belongs to the “heavy perception, light technology”, and smart phones or security industry attributes are completely different. In general, the smartphone camera is more in the sharing, such as high-definition and beauty; security camera is heavy record, the scene is relatively fixed and static; car camera is more inclined to intelligent, in real-time perception of various road conditions, and with the algorithm and processing chip integration to form an intelligent driving system.

Ⅱ High definition

According to available information, new car makers such as NIO, XIAOPENG, LEADING IDEAL, ZEEKR, neta have already taken the lead in carrying the highest specification 8MP ADAS cameras available, and traditional car companies have followed suit, such as the Great Wall Sharon Mecha Dragon, which is expected to be listed in Q2 this year, with seven 8M UHD cameras.

In addition, the surround view camera will progress from 1M to 3M and become mainstream.

At the supply level, Lcetron electronics has joined hands with Black Sesame technology, Baidu Apollo and other companies to create the world’s first ultra 15 million high pixel car camera products.

As the requirements of high-level self-driving to perceive the surrounding environment increase, the camera will evolve to “HD” in order to improve its image acquisition function and expand the detection distance and field of view.

It must be pointed out that HD will bring a spurt of data volume, which will bring high requirements and severe challenges to the computing power and algorithms of OEMs. The exponential growth of data processing brings about an increase in the demand for computing power, which in turn makes it necessary for OEMs to upgrade the underlying chip to reserve more computing resources; at the algorithm level, the different pixel lenses due to “detection distance and view angle” lead to inconsistent information contained in the data, which in turn makes the original neural network training algorithm model is not fully reusable The original neural network training algorithm model is not fully reusable and needs to be modified to improve comprehensive performance.

Therefore, OEMs do not blindly pursue ultra-high-definition pixels, but choose key cameras to upgrade.

Ⅲ shuffle

Car camera as the hottest gold-sucking field in recent years, is it too early to talk about reshuffling? In fact, otherwise, the market pattern has been in rapid change.

First, the domestic alternative.

At present, the market share of the larger occupants are mainly overseas first-line automotive Tier 1,but Desay SV,Sunny Smartlead, Hikvision, Lectron,Ofilm and other Chinese forces are rising in full force. Electrend 2023 domestic car camera three echelon formation, 2025 will be the car camera supply to foreign overtaking the time node.

As the concept of automotive supply chain level has been very blurred, upstream suppliers can provide complete products to downstream OEMs, so there is a subtle competition between domestic and foreign car camera companies at present.

Secondly, the moat is already in place.

The new players currently flooding into the in-car camera track are mostly optical manufacturers that started with cell phones, such as Quti and Sanwin Xing. On the contrary, many Tier1 believe that software margins are higher compared to hardware, so they no longer invest in camera hardware business on a large scale.

Automotive products with certification and delivery cycle is long, and definitely not a cell phone or security products model simple panning. Many want to gold car camera manufacturers due to the lack of technical support and customer resources, early fall in the market access threshold outside.