与阿尔卑斯、三美等海外强手掰腕高端,新思考以连续主供小米、华为两大厂牌旗舰手机的战绩脱颖而出,成为国产马达的攻坚代表。

3月30日,华为P60和P60 Pro首销大卖,当日销售额位居三大平台榜首。潮电智库拆解新机发现,华为P60 Pro后置黑夜长焦4800像素摄像头马达主要供应商为新思考。

据悉,这是新思考首次打入华为高端P系列供应链。早在去年年底,小米与新思考合作,在小米13系列旗舰机型摄像头上行业首发了内对焦OIS马达新技术。

潮电智库认为,产品供应被小米和华为两大头部生态巨头检验、肯定并纳入,其实也是新思考从“站立”到“站稳”高端的进阶之路。

从事马达行业十多年的资深专家堂哥表示,“新思考能够成功获得连续性的突破,主要有两大要素:一是手机行业竞争激烈,品牌端为了追求降本增效,供应链国产替代已是大势;二是新思考本身的技术产品硬实力过关,能够达到大厂严格的质量和应用标准。”

十年之战

追溯中国VCM马达发展历史,2013年是个值得铭记的时间点。

彼时,市场完全被日韩企业垄断。直到“中华酷联”带动智能手机的兴起,2013年国产VCM马达厂商如雨后春笋般涌出。2016年,数量达到峰值73家。

2018年,在AF开环马达市场,一直处于高位的日韩厂商因为价格及利润原因,选择放弃国内终端厂商的订单,中国马达力量抓住机遇大面积承接市场份额,得到茁壮成长。

同样在这一年,以华为和小米为代表,中国手机品牌扬名全球。

新思考、中蓝、皓泽、比路等国产马达借势而起,全面进入华为、小米、OPPO和vivo等中国主流手机品牌供应链,并在中低端产品线快速替代TDK、ALPS、MITSUMI等海外厂家。

但长期缺位高端市场,一直是国产马达的心头之憾。直到最近两年,新思考凭借技术创新与产品力接连撬开小米、华为等高端旗舰机型供应大门,成为国产马达的一面旗帜。

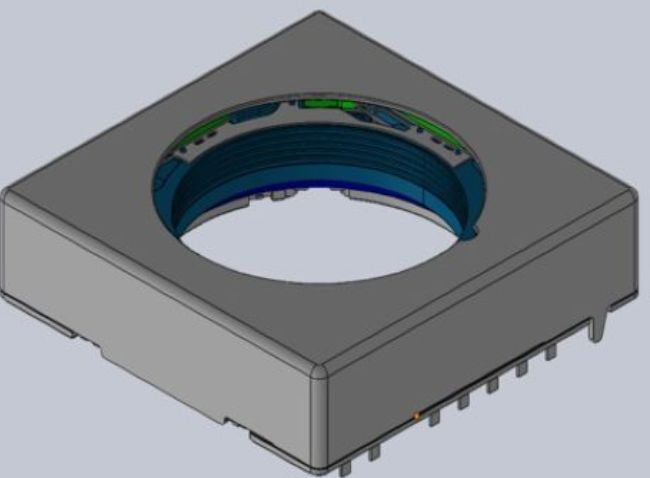

作为全球AF-VCM的鼻祖,新思考拥有授权发明专利、实用新型专利、外观设计专利合计超过700项,数量为行业之最,是欧菲、丘钛、舜宇、立景、合力泰、同兴达等模组厂的马达主力供应商,也是华为、小米、vivo、OPPO、联想、LG、华勤、闻泰、龙旗等终端的主力供应商。

十年之力勇往直前,国产马达终于处于行业的最顶端。

“大家在手机供应链板块找到了自己的位置并摆好了阵型,以后就是硬实力的比拼。”国内某一线马达厂商高管付S说,在高端市场的起点国内外玩家其实差不多,真正的竞争才刚刚开始。

国产之优

根据潮电智库1月中旬发布的“2022年全球马达出货量排行榜”显示,新思考出货量名列前茅,市占率接近12%,与排名榜首的阿尔卑斯相差不到5个百分点。

“不久之后,榜首位置一定属于国产厂商。”虽然去年智能手机行业为近十年来最差,并且市场还在持续下行,但在堂哥看来,这倒是手机摄像头马达加速国产替代的最佳时机。

严重内卷下产品配置却在不断提升,成本控制是整个手机产业链都面临的核心难题。堂哥表示,相比阿尔卑斯、三美、三星电机、TDK等海外厂商,以新思考为代表的国产马达除了明显的成本优势,在本地服务与交付能力的竞争中也全面胜出。

虽然身为友商,但付S还是客观认为,新思考成功打入小米和华为高端旗舰机供应链体系将纵横受惠。“一方面,按行业惯例,两家大厂可能会放开更多的机型与订单资源给核心供应商;另一方面,以此为有力背书,新思考可能承接到来自荣耀、OPPO和vivo等一线安卓阵营更多的高端项目。”

根据潮电智库分析,未来三年,全球智能手机销量会在11亿部左右徘徊。“华米Ov荣”等国产手机品牌会在影像升级、折叠屏等新形态方面持续冲击高端,这将留给国产马达足够的替代空间。

此外,从手机摄像头发展路线分析,超快对焦速度、超小型体积、低功耗、稳定性将是明朗趋势,因此核心结构件VCM马达在产品与市场端的比拼存有更多可能性。

潮电智库“2023年全球马达出货量排行榜”,也许会重新编写。

New-shicoh as Xiaomi and Huawei’s supplier, domestic motor become high-end brand

Competing with overseas giants such as Hapticand Sammi for high-end products, New-shicoh stands out with its continuous record of supplying flagship phones from two major brands, Xiaomi and Huawei.

On March 30th, Huawei’s P60 and P60 Pro sold well for the first time, ranking first among the three major platforms in terms of sales on that day. Chaodian Think Tank has disassembled a new camera and found that Huawei’s P60 Pro rear dark night telephoto 4800 pixel camera motor is mainly supplied by New Thinking.

It is reported that this is the first time that New-shicoh has entered Huawei’s high-end P-series supply chain. As early as the end of last year, Xiaomi cooperated with New-shicoh to launch the new technology of internal focusing OIS motor on the flagship camera of Xiaomi 13 series.

Electrend believes that the product supply has been tested, affirmed, and included by the two leading ecological giants, Xiaomi and Huawei, which is actually a new way of thinking from “standing” to “stable” high-end.

“Cousin, a senior expert who has been engaged in the motor industry for more than ten years, said, ‘New-shicoh can successfully achieve a continuous breakthrough, mainly due to two major factors: first, the mobile phone industry is highly competitive, and the brand end is seeking to reduce costs and increase efficiency, and domestic substitution in the supply chain has become a trend; second, New-shicoh’s own technical products have passed the standard of hard power, and can meet the strict quality and application standards of large factories.'”

Ten Years Wards

Tracing the development history of VCM motors in China, 2013 is a time point worth remembering.

At that time, the market was completely monopolized by Japanese and Korean enterprises. Until the rise of smart phones driven by ZTE, Huawei, coolpad and lenovo, domestic VCM motor manufacturers mushroomed in 2013. In 2016, the number reached a peak of 73.

In 2018, in the AF open loop motor market, Japanese and Korean manufacturers, which have been at a high level, chose to abandon orders from domestic end manufacturers due to price and profit reasons. Chinese motor forces seized the opportunity to take market share in a large area and thrive.

Also in this year, Chinese mobile phone brands, represented by Huawei and Xiaomi, became famous worldwide.

Domestic motors such as New-shicoh, ZET, Hozel, and Billu have taken advantage of this opportunity to fully enter the supply chain of mainstream Chinese mobile phone brands such as Huawei, Xiaomi, OPPO, and Vivo, and quickly replace overseas manufacturers such as TDK, ALPES, and SAMMI in mid to low end product lines.

However, the long-term absence of high-end market has always been a regret for domestic motors. Until the last two years, New-shicoh, relying on technological innovation and product strength, has successively opened the door to the supply of high-end flagship models such as Xiaomi and Huawei, becoming a flag of domestic motors.

As the originator of the global AF-VCM, New-shicoh has a total of over 700 authorized invention patents, utility model patents, and design patents, with the largest number in the industry. It is a major motor supplier for module manufacturers such as Ofilm, qtech, Sunny Optical, luxvisions, Holitech, and Tongxingda, as well as a major supplier for terminals such as Huawei, Xiaomi, Vivo, OPPO, Lenovo, LG, Huaqin, Wingtec, and Longcheer.

After ten years of effort, domestic motors have finally reached the top of the industry.

“Everyone has found their own position in the mobile phone supply chain sector and set up their own formation, and then there will be a competition of hard power.” Fu S, a senior executive of a domestic first-tier motor manufacturer, said that the starting point in the high-end market is actually similar between domestic and foreign players, and the real competition has only just begun.

Domestic excellence

According to the “2022 Global Motor Shipment Ranking List” released by the Chaodian Think Tank in mid January, New Thinking ranks among the top in terms of shipment volume, with a market share of nearly 12%, less than 5 percentage points from the top ranked Alps.

“In the near future, the top spot will definitely belong to domestic manufacturers.” Although last year’s smartphone industry was the worst in nearly a decade, and the market continues to decline, in my opinion, this is the best time to accelerate domestic replacement of mobile phone camera motors.

The product configuration has been continuously improved due to severe internal interference, and cost control is a core challenge facing the entire mobile phone industry chain. Cousin said that compared to overseas manufacturers such as Alps, Sanmei, Samsung Electric, and TDK, domestic motors represented by New-shicoh have not only significant cost advantages, but also comprehensively won the competition for local service and delivery capabilities.

Despite as a partner, Mr.S objectively believes that the successful penetration of the new thinking into the supply chain system of high-end flagship machines of Xiaomi and Huawei will benefit greatly. “On the one hand, according to industry practice, the two large factories may open up more models and order resources to core suppliers; on the other hand, as a strong endorsement, New Thinking may undertake more high-end projects from the frontline Android camp such as Honor, OPPO, and Vivo.”

According to the analysis of Electrend, global smartphone sales will hover around 1.1 billion units in the next three years. Domestic mobile phone brands such as “Huami, xiaomi, OPPO, VIVO” will continue to hit the high-end market in new forms such as image upgrades and folding screens, which will leave enough room for domestic motors to replace.

In addition, from the perspective of the development path of mobile phone cameras, ultra-fast focusing speed, ultra-small size, low power consumption, and stability will be a clear trend. Therefore, there are more possibilities for the core structure VCM motors to compete with the market.

The “2023 Global Motor Shipment Ranking List” of Electrend may be rewritten.